2020 tax calculator irs

The actual IRS tax return mailing address including UPS FEDEX options will be based on the state or territory you currently live or reside in and on the type of Form 1040 that you are filing and whether you expect a tax refund or submitting a tax. The IRS issued guidance Notice 2018-59 on June 22 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.

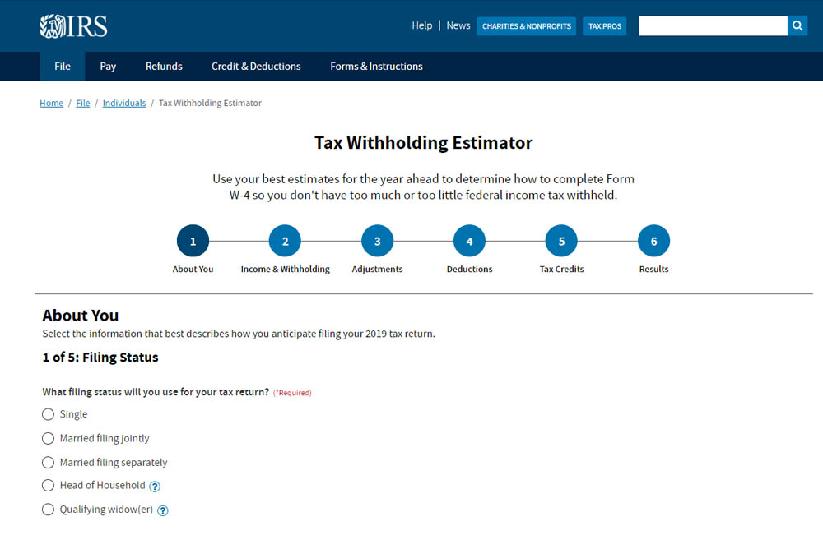

Irs Improves Online Tax Withholding Calculator

And line 4b to decrease the amount of income subject to withholding.

. Call 800-829-3676 to order prior-year forms and instructions. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

1 online tax filing solution for self-employed. Offer valid for returns filed 512020 - 5312020. How Tax Brackets Add Up.

Since that date 2020 Returns can only be mailed in on paper forms. You can get forms. The 2022 eFile Tax Season for 2021 Tax Returns starts in January 2022.

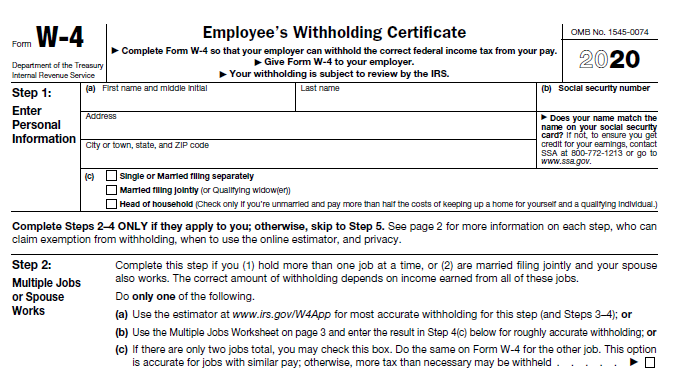

2022 Marginal Tax Rates Calculator. Go to IRSgovOrderForms to order current forms instructions and publications. So beginning in 2020 Form W-4 offers employees four ways to change their withholding.

This page provides detail of the Federal Tax Tables for 2020 has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR.

If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. Go to IRSgovForms to download current and prior-year. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Type of federal return filed is based. We welcome your comments about this publication and your suggestions for future editions. See Publication 505 Tax Withholding and Estimated Tax.

In 2020 the IRS collected close to 35 trillion in Federal taxes paid by individuals and businesses. The provided calculations do not constitute financial tax or legal advice. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel.

By using this site you agree to the use of cookies. This includes alternative minimum tax long-term capital gains or qualified dividends. Type of federal return filed is based on your personal tax situation and IRS.

WASHINGTON The Internal Revenue Service today issued the 2020 optional standard mileage rates PDF used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes. Offer valid for returns filed 512020 - 5312020. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Estimate your tax withholding with the new Form W-4P. These four possibilities.

If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. 2020 Tax Returns were able to be e-Filed up until October 15 2021. NW IR-6526 Washington DC 20224.

The IRS will process your order for forms and publications as soon as possible. IR-2019-215 December 31 2019. 2019 2020 2021.

Self-Employed defined as a return with a Schedule CC-EZ tax form. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. By using this site you agree to the use of cookies.

This site uses cookies. As a result taxpayers with taxable income of 523600 or more for single filers and 628300 or more for married couples filing jointly will be subject to the top marginal income tax rate of 37. Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options.

However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. Americas 1 tax preparation provider. The above calculator provides for interest calculation as per Income-tax Act.

Line 4c to increase the amount of tax withheld. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Ordering tax forms instructions and publications.

Leverage Your Home Equity Today. Type of federal return filed is based. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied.

5 - February 28 2018 at participating offices to qualify. Bentle K Berlin J and Yoder C. Getting tax forms instructions and publications.

1 online tax filing solution for self-employed. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. IRS Income Tax Forms Schedules and Publications for Tax Year 2020.

To do so you must have e-filed your original 2019 or 2020 return. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. 2020 September 18 Illinois income tax calculator.

Use the 2020 Tax Calculator to estimate your 2020 Return. Your tax situation is complex. Line 4a to increase the amount of income subject to withholding.

Americas 1 tax preparation provider. Dont resubmit requests youve already sent us. In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties select the Due Date on which your taxes should have been paid this is typically the 15 th of April and lastly select the Payment Date the date on which you expect to pay the full.

If you owe the IRS. Wheres my refund. Line 3 to reduce the amount of tax withheld.

Individuals accounted for about 536 of that total. Need Extra Funds to Cover Your Tax Obligations. 5 - February 28 2018 at participating offices to qualify.

IRS. Wheres my refund. You have nonresident alien status.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. January 1 - December 31 2020. To Get Tax Help section at the end of this publication go to the IRS Interactive Tax Assistant page at IRSgov HelpITA where you can find topics by using the search feature or viewing the categories listed.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

The Internal Revenue Service IRS has announced the annual inflation adjustments for the year 2020 including tax rate schedules tax tables and cost-of-living adjustments. Solar-Estimate has a tax incentive calculator and additional detailed information. The provided information does not constitute financial.

5 - February 28 2018 at participating offices to qualify. Pritzkers proposed graduated income tax affect you. Income limits for all tax brackets and filers will be modified for inflation in 2021 as stated in the tables below.

Irs Tax Withholding Estimator Irs Com

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

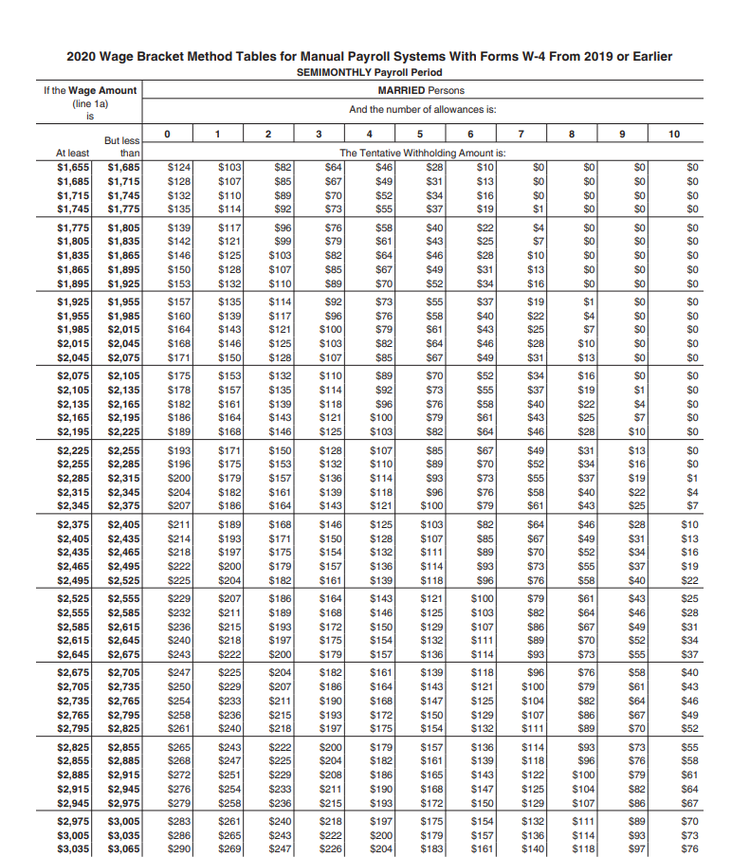

How To Calculate Federal Income Tax

The Irs Made Me File A Paper Return Then Lost It

2014 Federal Income Tax Forms Complete Sign Print Mail

How To Calculate Payroll Taxes For Your Small Business

Easiest Irs Interest Calculator With Monthly Calculation

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Refund Calendar Date Calculator

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Internal Revenue Code Simplified

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Calculator Estimate Your Income Tax For 2022 Free

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Refund Estimator Calculator For 2021 Return In 2022

What To Do If You Receive A Missing Tax Return Notice From The Irs

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network