47+ how to skip a mortgage payment without penalty

When you put relief options in place you can skip. Web Many lenders offer mortgage products that allow homeowners to skip between 1-4 monthly mortgage payments each year without question.

.jpg)

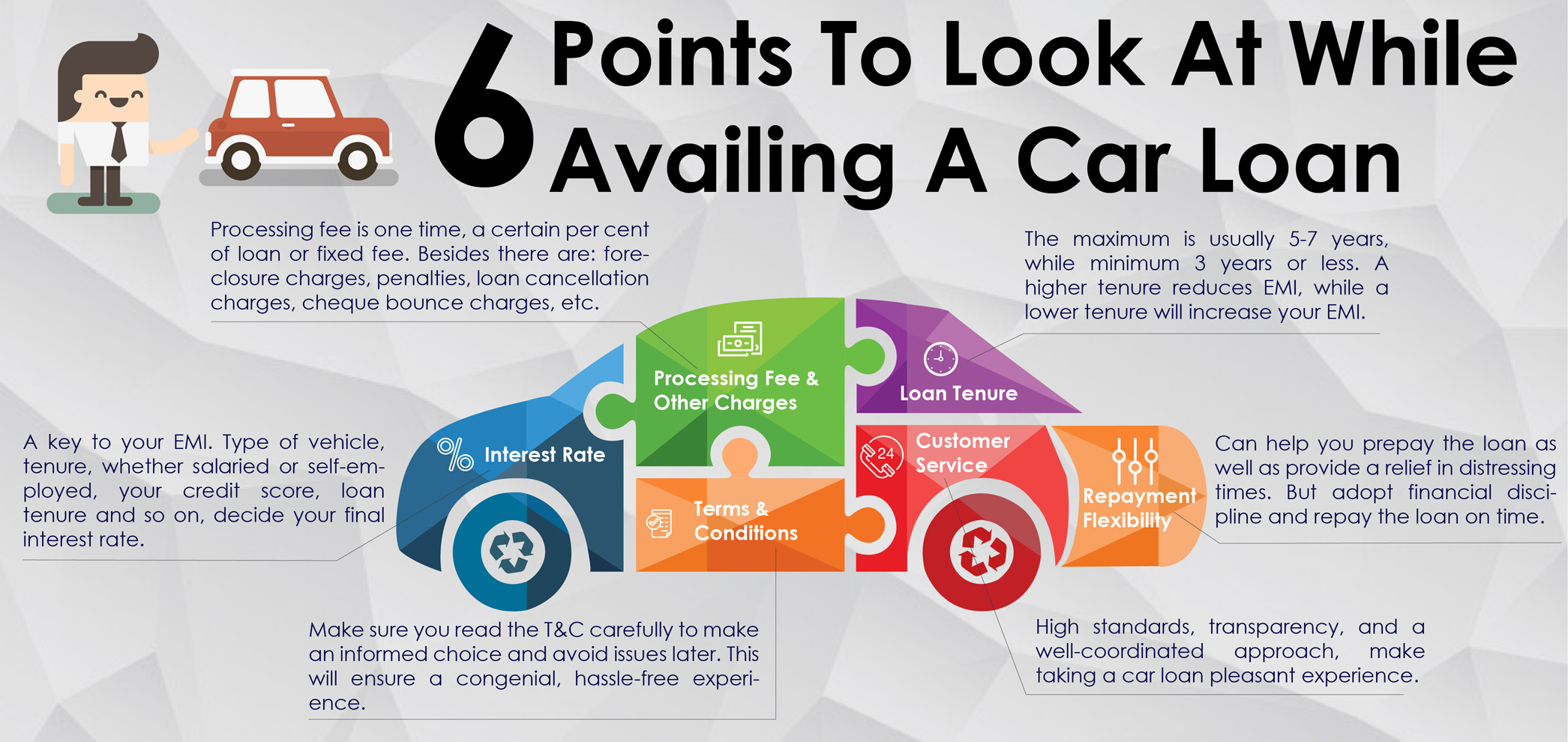

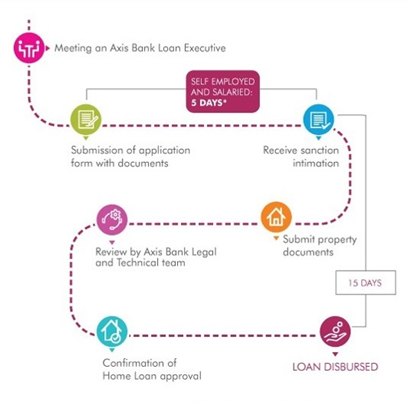

How A Self Employed Can Apply For A Car Loan Axis Bank

On most types of loans the late charge is only applied to principal and interest.

. Web Some loans have pre-payment penalties during the first years of the loan. These fees may impose substantial costs on homeowners with adjustable rate mortgage. But if you decide to pay off the entire balance all at once.

Web Wait until the second year to pay off the loan and you might owe a penalty equivalent to 1 of the mortgage balance. Web Most mortgage lenders let you pay as much as 20 of your loan balance each year without fear of any penalty. You can also incur a prepayment penalty if you attempt to pay off more than 20 percent of your loan.

Web Whether you can pay off your auto loan early without a penalty depends on your contract and on your states law. Ad Increasing Mortgage Payments Could Help You Save on Interest. Wait until maturity when your mortgage term is complete to make those prepayments.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Looking For Foreclosure Alternatives. If the lender wants to charge you a penalty or fee.

Web If your bank doesnt offer a specific skip-payment mortgage option it may still permit you to miss one or more payments under a forbearance or payment deferral. Summit Foreclosure Defense Works To Provide Our Clients Alternatives To Foreclosures. Web To determine the cost of the skipped payment we must determine the difference in total paid throughout the 25-year mortgage amortization period 514151 total mortgage -.

Web current posted interest rate for a mortgage with a 36-month term offered by your lender. 250000 mortgage for 30 years at 425 APR. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web A hard penalty occurs when you sell your home or refinance. Refinancing your mortgage to pay it off early only makes sense if you can get a lower interest rate or shorten the loan term. Some lenders might simply choose a.

When the term for your closed mortgage comes to an end you can put. Web Your credit will not suffer as long as you abide by the terms of your mortgage deferment or forbearance. The approximate fees are.

If you decide to skip a payment it simply means you wont be making one of your regular mortgage. 360 months 30 years 309 months 25 years 9 months While paying your mortgage off four. Web In some cases the amount charged for late payments is also limited by state law.

Need Time To Save Your Home. Ad Calculate Your Payment with 0 Down. Amount equal to 3 months interest on what you still owe.

Web Biweekly Repayment.

15050 114th St Nya Mn 55397 Zillow

Can You Skip A Mortgage Payment Learn About Mortgage Payments

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank

Home Loan Apply Housing Loan Online Rs 787 Lakh Emi Axis Bank

Can You Skip One Mortgage Payment Renewed Homes

![]()

Should You Skip Mortgage Payments If You Don T Have To

What Happens If You Miss A Mortgage Payment Credible

3131 Garrison Rd Fort Erie On L0s 1n0 Mls 40376141 Zillow

Little Kalama River Rd Woodland Wa 98674 Zillow

4 Ways To Calculate Mortgage Payments Wikihow

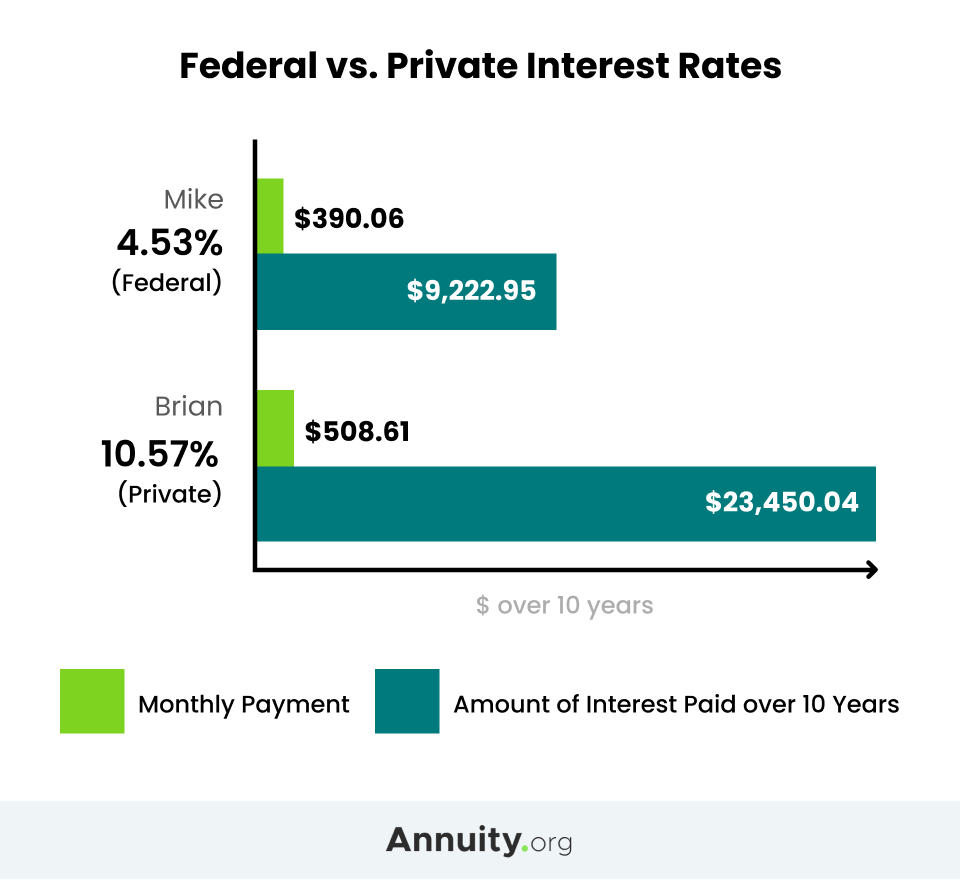

Students Basics For Financial Literacy Affording Tuition

![]()

Should You Skip Mortgage Payments If You Don T Have To

How To Skip 2 Mortgage Payments Youtube

What Happens When You Miss A Mortgage Payment Storeys

Should You Skip Mortgage Payments If You Don T Have To

How Can I Skip A Mortgage Payment

What Happens If You Miss A Mortgage Payment