32+ Oklahoma Vehicle Tax Calculator

The Sales Excise Tax Calculator is based on NADA listed pricing. Oklahoma levies two taxes on motor vehicles.

Oklahoma Form 2290 Heavy Highway Vehicle Use Tax Return

Web Motor vehicles taxes also categorized as tag agent remittances generated 4250 million in FY 2022 36 percent of total tax revenues.

. Web Updated on Sep 8 2023 Table of Contents Oklahoma charges two taxes for new car purchases. That puts Oklahomas top income tax rate in the bottom half of all states. 325 percent of purchase price.

South Dakota car sales tax rate in the USA. Web Taxes owed can be estimated using the Sales Excise Tax Calculator. Web Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles many independent and Department of Motor Vehicle.

Web Oklahoma Car Sales Tax Example. Report on Oklahomas Motor Vehicle Tax Structure Oklahoma Tax Commission March 9 1998. Web The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Web The tax rate of a vehicle in Oklahoma City is determined depending on the type of vehicle. Motor vehicle taxes in Oklahoma are both selective. Web Use our income tax calculator to estimate how much tax you might pay on your taxable income.

Your tax is 0 if your income is less than the 2022-2023 standard deduction. New York car sales tax rate in the USA. Typically the tax is.

Oklahomans also pay an annual registration fee in the amount of 125. 15 2023 at 906 AM PST LAWTON Okla. Here are the taxes owed.

Web How To Calculate Tag Title And Tax In Oklahoma. That year they were the 6th. NADA listed pricing can change.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on. Discover Helpful Information And Resources On Taxes From AARP. Go back to Sales Tax Go on to Motor Fuel Tax.

Web For the 2022 tax year Oklahomas top income tax rate is 475. 20 up to a value of 1500 plus 325 percent. Web How much is the sales tax on a car in Oklahoma.

New vehicle tax will run shoppers 325 of the purchase price while. Web Motor Vehicle Taxes. A 125 sales tax and a 325 excise tax for a total 45 tax rate.

Web How do you figure sales tax on a car in Oklahoma. Ad Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Web New Mexico car sales tax rate in the USA.

Lets say for example that you purchased a Toyota Tacoma for 2465700 in Oklahoma. Youll have to pay a sales tax rate of 125 and a vehicle excise tax. KSWO - A current bill making its way through the Oklahoma legislature hopes to change the way excise tax on.

Web This calculator will provide an estimate based on all relevant factors and will also provide a breakdown of any additional taxes or fees that may be due at the time of. The state charges a tax rate of 45 on all car purchases.

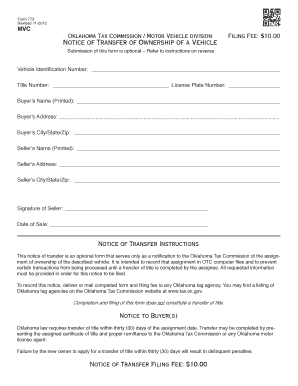

Oklahoma Title Transfer Form Fill Online Printable Fillable Blank Pdffiller

Used Gmc Canyon Trucks For Sale Near Me Cars Com

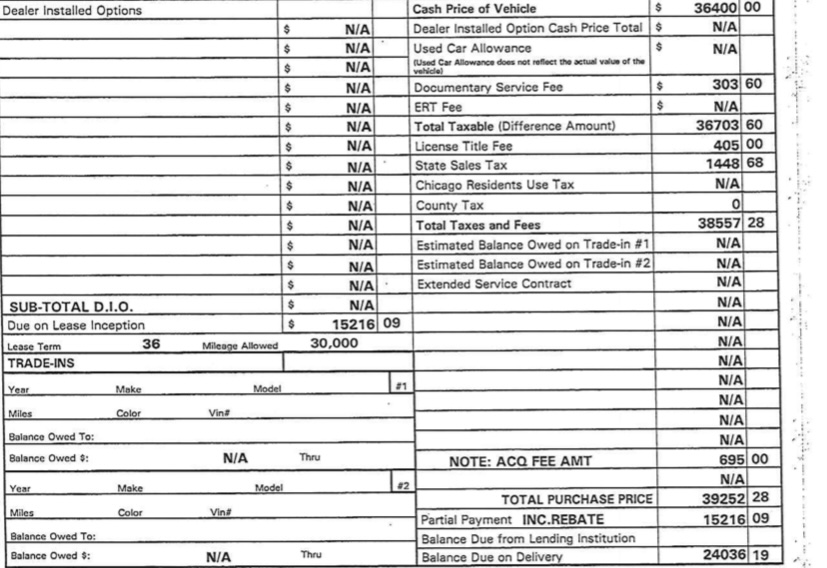

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Zz7k0xq1kgfoom

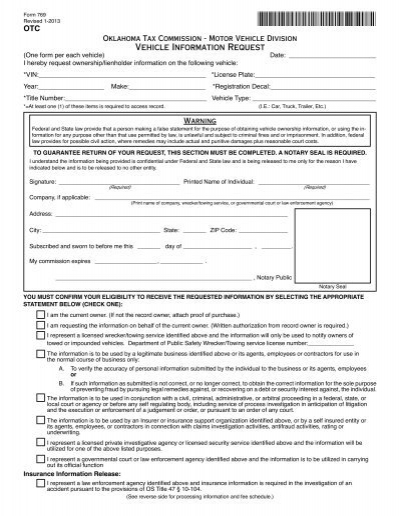

Vehicle Information Request Form Oklahoma Tax Commission

Lariat 2032r 32 Hp Tractor Package Special

Oklahoma Drivers Must Carry Registration Starting July 1

Oklahoma Income Tax Calculator Smartasset

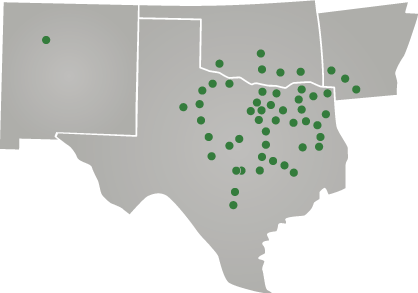

State And Local Laws And Regulations Updated Survey Of Laws And Regulations Applicable To Airport Commercial Ground Transportation The National Academies Press

Vancouver Courier October 11 2018 By Vancouver Courier Issuu

Cstore Decisions January 2022 By Wtwh Media Llc Issuu

31gya51luouj1m

Form 2290 Tax Calculation Estimate Your Hvut Truck Tax Online

Wallstreetjournal 20210611 Thewallstreetjournal Pdf Unemployment Social Science

Pdf Nephrology Social Workers Caseloads And Hourly Wages In 2014 And 2017 Findings From The National Kidney Foundation Council Of Nephrology Social Workers Professional Practice Survey

Used Trucks For Sale In Jacksonville Fl Cars Com

Certificate Of Registration